Latest News: Mountain Alliance AG further expands portfolio in the Defence Tech sector with investment in MindGuard AG

Latest News: Mountain Alliance AG further expands portfolio in the Defence Tech sector with investment in MindGuard AG

A German Venture Capital company

Strategic investment in digital growth companies - built to generate long-term value, not just hold stakes. We back scalable tech businesses and help turn potential into performance.

Our Portfolio

Our Portfolio

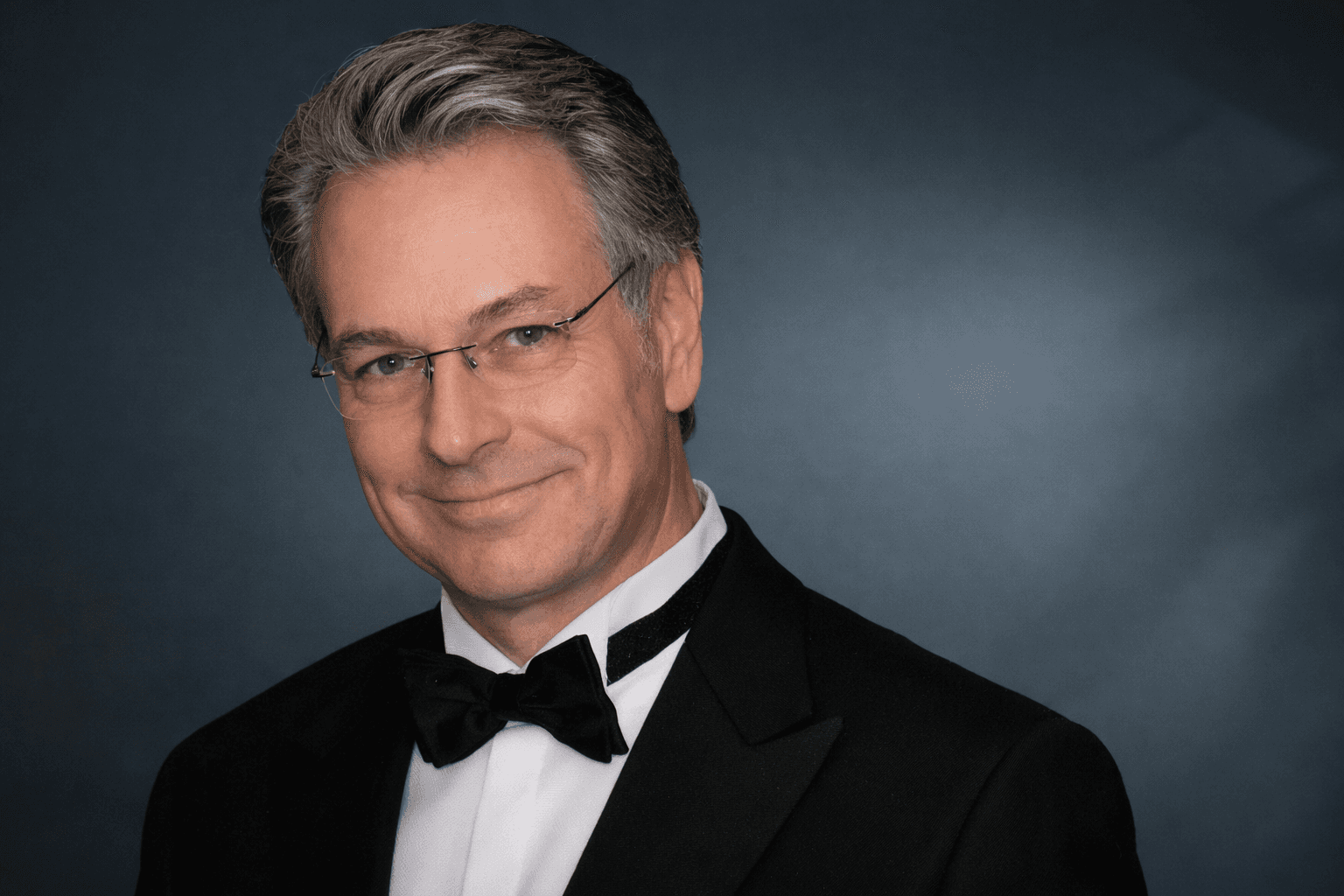

"We invest in companies

that shape the world of tomorrow."

Dr. Hans Ulrich Tetzner

Manegement Board

"We invest in companies

that shape the world of tomorrow."

Dr. Hans Ulrich Tetzner

Manegement Board

"We invest in companies

that shape the world of tomorrow."

Dr. Hans Ulrich Tetzner

Manegement Board

"We invest in companies

that shape the world of tomorrow."

Dr. Hans Ulrich Tetzner

Manegement Board

We provide access to digital value creation through a listed, evergreen vehicle — with a strategic focus on Defense Tech.

Dr. Hans Ulrich Tetzner

Management

Dr. Hans Ulrich Tetzner

Details

Dr. Hans Ulrich Tetzner

Management

Dr. Hans Ulrich Tetzner

Details

Dr. Hans Ulrich Tetzner

Management

Dr. Hans Ulrich Tetzner

Details

Dr. Hans Ulrich Tetzner

Management

Dr. Hans Ulrich Tetzner

Details

Dr. Cornelius Boersch

Chairman

Dr. Cornelius Boersch

Details

Dr. Cornelius Boersch

Chairman

Dr. Cornelius Boersch

Details

Dr. Cornelius Boersch

Chairman

Dr. Cornelius Boersch

Details

Dr. Cornelius Boersch

Chairman

Dr. Cornelius Boersch

Details

Daniel Wild

Vice Chairman

Daniel Wild

Details

Daniel Wild

Vice Chairman

Daniel Wild

Details

Daniel Wild

Vice Chairman

Daniel Wild

Details

Daniel Wild

Vice Chairman

Daniel Wild

Details

Daniel S. Wenzel

Board Member

Daniel S. Wenzel

Details

Daniel S. Wenzel

Board Member

Daniel S. Wenzel

Details

Daniel S. Wenzel

Board Member

Daniel S. Wenzel

Details

Daniel S. Wenzel

Board Member

Daniel S. Wenzel

Details

Investment

Approach

We facilitate public investors’ participation in European Tech value creation

Our Venture Capital Approach

Our Venture Capital Approach

Our Venture Capital Approach

Our Venture Capital Approach

Reduced Risk

Investment in existing, well-diversified, comparatively mature portfolio

Investment in "blind pool" of (early stage) assets

Cost

Efficient

Reduced OPEX through dividends / profit transfer from fully consolidated companies

2% Management fee + 20% carried interest

Flexible

Individual shareholding volume and timespan

At least 8+2(+x) years until fund liquidation and minimum ticket size

Convenient

Listed share on Xetra, Frankfurt, Munich

Time consuming KYC / QIB process

Many value Creators in One Share

Value Creators in

One Share

Many value

Creators in One Share

One share of Mountain Alliance contains years of investment expertise and a well diversified portfolio of technology driven disruptors

We back our most promising companies with all our resources

What we

invest in

01

Disruption

We invest in digital, disruptive and scalable businesses driven by passionate teams

02

Growth

We invest in growth companies

that generate significant revenues

03

Profitability

We invest in companies following a visible and credible path to profitability

04

Maturity

We invest in companies with an exit horizon of 4-6 years

01

Disruption

We invest in digital, disruptive and scalable businesses driven by passionate teams

02

Growth

We invest in growth companies

that generate significant revenues

03

Profitability

We invest in companies following a visible and credible path to profitability

04

Maturity

We invest in companies with an exit horizon of 4-6 years

01

Disruption

We invest in digital, disruptive and scalable businesses driven by passionate teams

02

Growth

We invest in growth companies

that generate significant revenues

03

Profitability

We invest in companies following a visible and credible path to profitability

04

Maturity

We invest in companies with an exit horizon of 4-6 years

01

Disruption

We invest in digital, disruptive and scalable businesses driven by passionate teams

02

Growth

We invest in growth companies

that generate significant revenues

03

Profitability

We invest in companies following a visible and credible path to profitability

04

Maturity

We invest in companies with an exit horizon of 4-6 years

How we

invest

How we

invest

01

Discipline

We pursue accretive acquisitions by buying portfolios to discount to NAV

02

Network

We leverage the Mountain Partners and Mountain Alliance network to access to a large number of interesting portfolios

03

Diversification

We invest in portfolios which contain companies that we already hold shares in rather than single assets

04

Synergy

We actively seek targets that can be accelerated with existing service companies

01

Discipline

We pursue accretive acquisitions by buying portfolios to discount to NAV

02

Network

We leverage the Mountain Partners and Mountain Alliance network to access to a large number of interesting portfolios

03

Diversification

We invest in portfolios which contain companies that we already hold shares in rather than single assets

04

Synergy

We actively seek targets that can be accelerated with existing service companies

01

Discipline

We pursue accretive acquisitions by buying portfolios to discount to NAV

02

Network

We leverage the Mountain Partners and Mountain Alliance network to access to a large number of interesting portfolios

03

Diversification

We invest in portfolios which contain companies that we already hold shares in rather than single assets

04

Synergy

We actively seek targets that can be accelerated with existing service companies

01

Discipline

We pursue accretive acquisitions by buying portfolios to discount to NAV

02

Network

We leverage the Mountain Partners and Mountain Alliance network to access to a large number of interesting portfolios

03

Diversification

We invest in portfolios which contain companies that we already hold shares in rather than single assets

04

Synergy

We actively seek targets that can be accelerated with existing service companies

Share Price Development

ECF chart by TradingView

Share Information

Share Information

01

ISIN

DE000A12UK08

WKN

A12UK0

Tickersymbol

ECF

Share category

Registered shares

Industry

Information technology

Total number of shares

7’569’205

Share capital

EUR 7’569’205,00

Shareholder structure

Mountain Partners AG (47.9%)

Roots Capital (8.3%)

Reitham Equity GmbH (7.5%)

PEN GmbH (7.4%)

Tiburon Unternehmensaufbau GmbH (4.0%)

Stock exchange listing

m:access (Freiverkehr) at Börse München

Basic Board (Open Market) at Frankfurter Wertpapierbörse

Specialist

Baader Bank AG

Emission expert

Small & Mid Cap Investmentbank AG

Designated Sponsor

BankM AG

01

ISIN

DE000A12UK08

WKN

A12UK0

Tickersymbol

ECF

Share category

Registered shares

Industry

Information technology

Total number of shares

7’569’205

Share capital

EUR 7’569’205,00

Shareholder structure

Mountain Partners AG (47.9%)

Roots Capital (8.3%)

Reitham Equity GmbH (7.5%)

PEN GmbH (7.4%)

Tiburon Unternehmensaufbau GmbH (4.0%)

Stock exchange listing

m:access (Freiverkehr) at Börse München

Basic Board (Open Market) at Frankfurter Wertpapierbörse

Specialist

Baader Bank AG

Emission expert

Small & Mid Cap Investmentbank AG

Designated Sponsor

BankM AG

01

ISIN

DE000A12UK08

WKN

A12UK0

Tickersymbol

ECF

Share category

Registered shares

Industry

Information technology

Total number of shares

7’569’205

Share capital

EUR 7’569’205,00

Shareholder structure

Mountain Partners AG (47.9%)

Roots Capital (8.3%)

Reitham Equity GmbH (7.5%)

PEN GmbH (7.4%)

Tiburon Unternehmensaufbau GmbH (4.0%)

Stock exchange listing

m:access (Freiverkehr) at Börse München

Basic Board (Open Market) at Frankfurter Wertpapierbörse

Specialist

Baader Bank AG

Emission expert

Small & Mid Cap Investmentbank AG

Designated Sponsor

BankM AG

01

ISIN

DE000A12UK08

WKN

A12UK0

Tickersymbol

ECF

Share category

Registered shares

Industry

Information technology

Total number of shares

7’569’205

Share capital

EUR 7’569’205,00

Shareholder structure

Mountain Partners AG (47.9%)

Roots Capital (8.3%)

Reitham Equity GmbH (7.5%)

PEN GmbH (7.4%)

Tiburon Unternehmensaufbau GmbH (4.0%)

Stock exchange listing

m:access (Freiverkehr) at Börse München

Basic Board (Open Market) at Frankfurter Wertpapierbörse

Specialist

Baader Bank AG

Emission expert

Small & Mid Cap Investmentbank AG

Designated Sponsor

BankM AG

Performance

Company Presentation

Company Presentation

22/06/2025

22/06/2025

Financial

Calendar

Publication Annual Report 2025

May 2026

Publication Annual Report 2025

May 2026

Publication Annual Report 2025

May 2026

Publication Annual Report 2025

May 2026

Equityforum Spring Conference

May 12-14th 2025

Frankfurt / Main

Equityforum Spring Conference

May 12-14th 2025

Frankfurt / Main

Equityforum Spring Conference

May 12-14th 2025

Frankfurt / Main

Equityforum Spring Conference

May 12-14th 2025

Frankfurt / Main

Annual General Meeting

July 2025

Annual General Meeting

July 2025

Annual General Meeting

July 2025

Annual General Meeting

July 2025

Publication Half - Year Report 2026

September 26th 2026

Publication Half - Year Report 2026

September 26th 2026

Publication Half - Year Report 2026

September 26th 2026

Publication Half - Year Report 2026

September 26th 2026

Hamburger Investorentag

August 27-28th 2025

Hamburg

Hamburger Investorentag

August 27-28th 2025

Hamburg

Hamburger Investorentag

August 27-28th 2025

Hamburg

Hamburger Investorentag

August 27-28th 2025

Hamburg

German Equity Forum

November 24-26th 2025

Frankfurt / Main

German Equity Forum

November 24-26th 2025

Frankfurt / Main

German Equity Forum

November 24-26th 2025

Frankfurt / Main

German Equity Forum

November 24-26th 2025

Frankfurt / Main

We focus on

Growth financing

We invest in companies

that shape the world of tomorrow.

Let´s go

Let´s go

Let´s go

Let´s go

Early

stage

We do not invest early stage

Growth

We support your expansion

and internationalization

Flexible

We back our winners all the

way to IPO or exit

Secondary

We prefer to acquire entire portfolios

We offer strategic, operational and financial support

Public market access

We establish our assets’ brands at public investors

Flexibility

We are not tied to fund life cycles. We provide capital synchronized with our companies’ developments

Entrepre-neurial experience

We founded companies ourselves and guided them (some of them) all the way to IPO

Digital business services

Our companies get preferred access to our digital business services

What we

invest in

01

Disruption

We invest in digital, disruptive and scalable businesses driven by passionate teams

02

Growth

We invest in growth companies

that generate significant revenues

03

Profitability

We invest in companies following a visible and credible path to profitability

04

Maturity

We invest in companies with an exit horizon of 4-6 years

01

Disruption

We invest in digital, disruptive and scalable businesses driven by passionate teams

02

Growth

We invest in growth companies

that generate significant revenues

03

Profitability

We invest in companies following a visible and credible path to profitability

04

Maturity

We invest in companies with an exit horizon of 4-6 years

01

Disruption

We invest in digital, disruptive and scalable businesses driven by passionate teams

02

Growth

We invest in growth companies

that generate significant revenues

03

Profitability

We invest in companies following a visible and credible path to profitability

04

Maturity

We invest in companies with an exit horizon of 4-6 years

01

Disruption

We invest in digital, disruptive and scalable businesses driven by passionate teams

02

Growth

We invest in growth companies

that generate significant revenues

03

Profitability

We invest in companies following a visible and credible path to profitability

04

Maturity

We invest in companies with an exit horizon of 4-6 years